Why is it that women physicians lack the ability to create as much wealth as their male counterparts? Some of it has to do with the difference in their compensation, for sure. But once the salary is paid out, how do they spend it?

The primary difference in the financial health of women physicians versus their male counterparts is how they allocate the funds. Women will be more disciplined in saving for specific life events, mostly around their children: weddings, college education costs, down payments for a home, a second/vacation home, and grandchildren. Men will do some of that, but they usually spend their funds on the things they want for themselves first: the new car, the golf clubs, the vacations, the sports equipment. If there is something left, they will allocate it to life events, too. More than one male physician told me he believes he deserves whatever the current prize is for his years of dedication, sacrifice, and hard work. He is also more susceptible to “doctor deals”, those less than investment quality flyers his buddies talk about in the operating room or at the country club. And sometimes they pay off big time. They create wealth in a heartbeat. Or not.

Women physicians are far less apt to invest in these “risky” deals. As a matter of fact, they are TOO conservative and opt for the more guaranteed, “safer” investment vehicles. If their goals in investing are to have money available for these life events, they do not want to risk the possibility the money won’t be there when they need it. And in doing so, they pass up the potential for real growth in the money they invest.

When polled for which investment choices they make in 401k plans, women choose the bond portfolios and those which invest in guaranteed instruments. Very little is placed in mutual funds focused on stocks. So, if all things were equal and they both invested the same money in the 401k plans, most men would outperform their female colleagues dramatically, simply by the difference in the investment choices they made.

Women need to understand risk when it comes to personal finance. In all cases, some risk is good. It helps to protect their investments from the ravages of inflation and taxes and shows real growth over a time period. For short term goals, it is probably not the best path; for longer term goals, like retirement, it is essential.

For help in this and all things financial, please contact us.

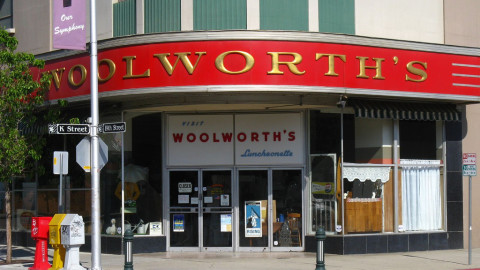

Photo Credit: Don_Vito_Corleone via Compfight cc